Need to know

- Raising a child in South Africa can cost around R3.3 million, even without private schooling or overseas studies.

- Starting to save early can cut your education costs by half and give your child more opportunities.

- An education plan helps you ease future financial pressure and secure your child’s future dreams.

A quality education is one of the best investments you can make in your child’s future, but it comes with a big price tag. The good news? With a clear savings plan and an early start, you can make your child’s education far more affordable.

Here, we break down how much a child really costs, why saving upfront with an education savings plan makes such a difference and how you can start planning for your child’s education.

What does raising a child cost you in South Africa?

In June 2024 we did quite extensive research to try and answer this question as well as we can. View our methodology on what a child can cost.

The bottom line was that it could be, without clothes and food, R3 million. This is if your child doesn’t go to private schools and study at a local university for three years. If we adapt this number with inflation, it could be R3.3 million now.

Raising a child can cost you R3 million.

If you start saving when a child is born, tertiary education could cost half of what it would have.

What are the benefits of starting an education savings plan for your children?

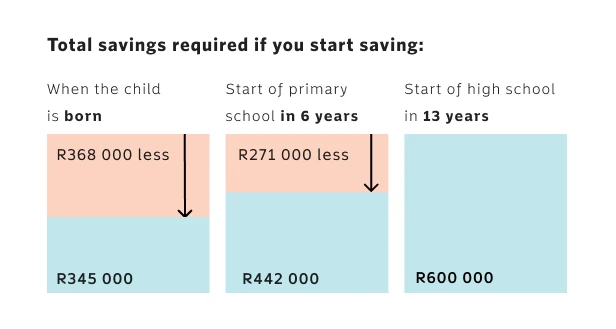

To make things simpler, let’s do only the university sum. We assume you’ll need R713 000 (plus inflation) in 18 years’ time for a three-year degree. We’ll show you the difference between starting to save as soon as a child is born, waiting until they start school, or waiting until high school.

How to start saving for education

You’ll never regret taking out an education policy or endowment. It’s a smart way to reduce future financial pressure and avoid relying on loans, while giving your child the freedom to choose the education path that suits them best. Whether they pursue university or another vocational path, starting to save early helps you set them up for success without compromising your own financial future.

Yes, raising a child is expensive from day one. But by saving from as little as R500 a month with an education savings plan from Momentum Savings, you can make the dream of that black graduation gown a greater reality.